Alerts

IRS Issues Final Regulations Addressing Ownership of Domestically Controlled REITs

April 29, 2024

On April 24, 2024, the Internal Revenue Service (“IRS”) released final regulations (TD 9992) (“Final Regulations”) addressing the determination of whether a real estate investment trust (“REIT”) is “domestically controlled.” The Final Regulations finalize proposed regulations (REG-100442-22) (“Proposed Regulations”) under Section 897 of the Internal Revenue Code published on Dec. 29, 2022.[1]

The Final Regulations largely adopt the Proposed Regulations with certain modifications. Notably, the Final Regulations (i) look through a non-public domestic C corporation if foreign persons hold directly or indirectly more than 50 percent (revised from 25 percent or more in the Proposed Regulations) and (ii) include a 10-year transition period for existing structures with respect to the domestic corporation look-through rule.

The transition relief alleviates certain concerns of non-US investors related to existing investments in REITs that were previously thought to be domestically controlled REITs but that do not meet the requirements to be domestically controlled under the Proposed Regulations and the Final Regulations. However, monitoring of underlying ownership of a REIT and the asset holdings of a REIT is necessary to ensure the continued eligibility of such REITs for transition relief.

In addition, the Final Regulations provide clarity on which types of entities are “foreign persons” for purposes of determining domestically controlled status by finalizing, with minor changes, the definition outlined in the Proposed Regulations.

Background

Under the Foreign Investment in Real Property Tax Act of 1980 (“FIRPTA”), foreign corporations and nonresident aliens are generally subject to US federal income tax on any gain arising from the disposition of a US real property interest (“USRPI”). A USRPI includes an interest in a domestic corporation that was a United States real property holding corporation (“USRPHC”) at any time during the shorter of the five-year period ending on the date of the disposition of the interest or the period during which the taxpayer held the interest. A USRPHC is any corporation if the fair market value of its USRPIs equals or exceeds 50 percent of the sum of the fair market value of its real property interests and any other assets used or held for use in a trade or business. However, a USRPI does not include an interest in a REIT (or a regulated investment company (“RIC”) that is a USRPHC) that is “domestically controlled” (“DC REIT”). Accordingly, gain or loss on the disposition of stock in a DC REIT generally is not subject to tax under FIRPTA and ownership of DC REIT stock would not be considered ownership of a USRPI.

A REIT generally is considered “domestically controlled” if less than 50 percent of the value of the REIT’s stock is held “directly or indirectly” by foreign persons at all times during the five-year period ending on the date of the disposition of an interest in the REIT (or during the REIT’s existence if shorter).

The Proposed Regulations provided an interpretation of the phrase “directly or indirectly” with respect to the treatment of DC REIT ownership through partnerships and, in a departure from prior guidance, introduced a “foreign-owned” domestic corporation look-through rule (now modified to a “foreign-controlled” domestic corporation look-through rule in the Final Regulations, as discussed below). The Proposed Regulations would have applied to transactions occurring after the date final regulations were published, which, had transition relief not been included in the Final Regulations, would have potentially impacted existing structures as a result of the five-year look-back period.

Summary of the Final Regulations Under Section 897

General Approach

The Final Regulations generally follow the Proposed Regulations in adopting a partial look-through approach for purposes of determining whether a REIT is domestically controlled, dividing owners into “non-look-through persons” and “look-through persons.” Only non-look-through persons are taken into account in determining whether a REIT is domestically controlled.

Where a non-look-through person holds an interest in a REIT via a look-through person, the non-look-through person’s ownership of the REIT is determined based on the non-look-through person’s proportionate interest in the look-through person. The Final Regulations do not provide guidance regarding how to calculate ownership percentages for a situation in which the look-through person is a partnership with diverging capital and profits interests.

Non-look-through persons include the following categories:

- Individuals;

- Domestic C corporations (other than non-public “foreign-controlled” domestic C corporations discussed below);

- Certain tax exempt organizations and governmental entities;

- Foreign corporations (including foreign governments);

- Publicly traded partnerships (domestic or foreign);

- Certain public RICs;

- Estates (domestic or foreign);

- Certain international organizations;

- Certain public REITs;

- Qualified foreign pension funds and qualified controlled entities; and

- Any person that holds less than five percent of any class of stock of a REIT that is regularly traded on an established securities market (with such person treated as a US person unless the REIT (i) has actual knowledge to the contrary or (ii) has actual knowledge that such person is “foreign controlled” (as described further below)).

Look-through persons are any persons who are not non-look-through persons and include, for example, non-public REITs and RICs, S corporations, non-publicly traded partnerships (domestic and foreign) and trusts (domestic and foreign).

Domestic Corporation Look-Through Rule

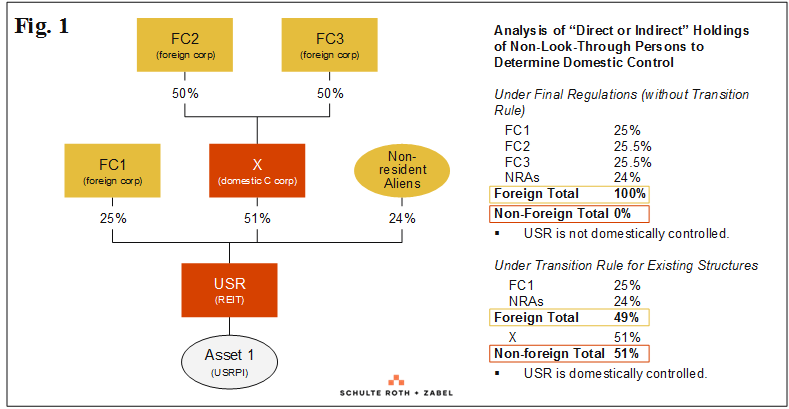

The Final Regulations contain a look-through rule that requires looking through any non-public “foreign-controlled” domestic C corporation in which foreign persons hold directly or indirectly more than 50 percent of the fair market value of the corporation’s outstanding stock (the “Domestic Corporation Look-Through Rule”). The determination of whether a domestic C corporation is foreign-controlled is made by applying the same rules that apply for purposes of determining whether a REIT is domestically controlled. See Fig. 1 below for an illustration of the Domestic Corporation Look-Through Rule.

Actual Knowledge of Foreign Control

The Final Regulations include additional limitations that modify certain provisions if the REIT has “actual knowledge” that an entity is foreign controlled. As described above, the rule treating any person holding less than five percent of any class of stock of a regularly traded REIT as a US non-look-through person is turned off if the REIT has actual knowledge that such person is “foreign controlled” (treating any person that is not a non-public domestic C corporation as if it were a non-public domestic C corporation for this purpose). In addition, the Final Regulations treat public domestic C corporations, publicly traded partnerships and public RICs as look-through persons if the REIT has actual knowledge that such entity is foreign controlled.

Treatment of QFPFs

Consistent with the Proposed Regulations, under the Final Regulations, qualified foreign pension funds (“QFPFs”) and certain entities owned by QFPFs are considered foreign persons for purposes of determining whether a REIT is domestically controlled.

Applicability Dates and Transition Rule

The Final Regulations generally apply to transactions occurring on or after April 25, 2024, but include a transition rule that exempts existing structures from the Domestic Corporation Look-Through Rule for a period of ten years, provided that they meet certain requirements (“Transition Rule”).

Fig. 1, below, illustrates the domestic control analysis (i) under the Final Regulations (as applicable to new entities and existing entities that do not qualify for the Transition Rule), and (ii) under the Transition Rule (as applicable to entities that meet the requirements described below), which removes the application of the Domestic Corporation Look-Through Rule and instead treats foreign-controlled domestic C corporations as non-look-through persons.

The Transition Rule provides that, for a REIT in existence as of April 24, 2024, that is otherwise domestically controlled (without applying the Domestic Corporation Look-Through Rule) and satisfies the following requirements, the Domestic Corporation Look-Through Rule will not apply until the earlier of (i) April 24, 2034, or (ii) the date the REIT fails to meet either one of the following two requirements:

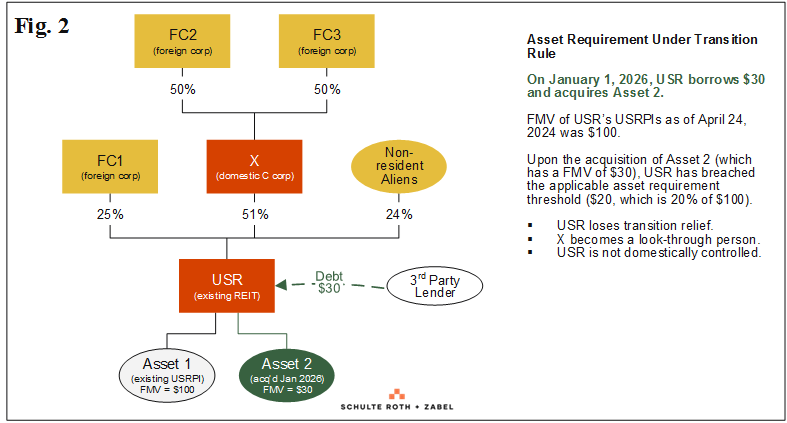

- Asset Requirement: The aggregate fair market value of any USRPIs acquired by the REIT after April 24, 2024, must not exceed 20 percent of the aggregate fair market value of the USRPIs held by the REIT as of April 24, 2024 (“Asset Requirement”).

- Ownership Requirement: The percentage of the stock of the REIT (determined by applying the final domestic corporation look-through rule and based on fair market value) held directly or indirectly by one or more non-look-through persons — whether US persons or non-US persons — must not increase by more than 50 percentage points in the aggregate over the percentage of stock of the REIT owned directly or indirectly by such non-look-through persons on April 24, 2024 (“Ownership Requirement”).

For purposes of the Asset Requirement and the Ownership Requirement, an acquisition of a USRPI or the stock of a REIT pursuant to a written agreement binding before April 24, 2024 (and at all times thereafter) or pursuant to certain tender offers is treated as occurring on April 24, 2024. For purposes of the ownership test, a REIT’s publicly traded stock owned by persons holding less than 5 percent is treated as owned by a single non-look-through person, except if the REIT has actual knowledge regarding the ownership of any person.

If the Transition Rule ceases to apply, analysis of the testing period to determine domestic control (i.e., the five-year look-back) still takes into account the Transition Rule for the period prior to failing to meet either of the above requirements (i.e., the Domestic Corporation Look-Through Rule applies prospectively).

The examples below in Fig. 2 and Fig. 3 illustrate the Asset Requirement and Ownership Requirement, respectively.

Key Takeaways

Existing REITs

Investment funds with private REITs in their structures should consider whether the Transition Rule will be applicable. If a REIT currently qualifies for transition relief, considerations regarding the REIT’s continued eligibility must be monitored when acquiring additional assets or changing the REIT’s ownership composition.

DC REITs looking to acquire additional USRPIs will need to evaluate the fair market value of their USRPIs as of April 24, 2024, and carefully monitor the aggregate fair market value of any newly acquired USRPIs. Fair market value is calculated without regard to debt. The threshold under the Asset Requirement is static and set as of April 24, 2024, such that subsequent changes in value of already-owned USRPIs have no effect. Additionally, there is no netting mechanism provided under the Asset Requirement, and so a DC REIT that acquires any additional USRPIs still must count the newly acquired assets under the Asset Requirement even in the event that the DC REIT also disposes of any existing USRPIs. Furthermore, USRPIs acquired by way of “like-kind” exchanges under Section 1031 were not addressed in the Final Regulations and, therefore, appear to be acquisitions that would be taken into account in determining whether the Asset Requirement has been breached.

In addition to transfers of DC REIT shares, funds will need to consider non-pro-rata issuances and redemptions to determine the increase in percentage ownership of a DC REIT under the Ownership Requirement. While an “F” reorganization of an owner of a DC REIT explicitly does not cause a change in ownership under the Final Regulations, other nonrecognition transactions and transfers by operation of law (e.g., at death or upon an entity’s dissolution) are not addressed. By negative implication, such transfers may be taken into account under the Ownership Requirement and result in a failure to qualify for transition relief.

Earlier guidance from the IRS in a Private Letter Ruling permitted restrictions on the liquidity of DC REIT stock imposed in order to maintain domestically controlled status, despite the general requirement under the REIT rules that REIT shares must be transferable.[2] Therefore, DC REITs needing the benefit of the Transition Rule in order to maintain status as a DC REIT would seem to be permitted to put restrictions into place against transfers that would cause the REIT to fail to satisfy the Ownership Requirement.

All REITs

Funds with REITs in their structures should consider their ability to solicit information from existing and prospective investors for purposes of determining DC REIT status. The preamble to the Final Regulations notes that a REIT must take appropriate measures to determine the identity of its direct and indirect shareholders in determining whether it is domestically controlled, but the Final Regulations do not prescribe a specific form or method.

Illustrative Examples

The following examples are adapted from Example 5 of the Final Regulations.

Please contact your Schulte Roth & Zabel LLP tax attorney for any questions about the potential consequences of the Final Regulations.

Authored by Philippe Benedict, David S. Griffel, Andi Mandell, Joseph Reich, Shlomo C. Twerski, Alan S. Waldenberg, David S. Wermuth, Christine Harlow, Bryson Kern and Hannah J. Wells.

[1] For further discussion of the Proposed Regulations, see our prior Alert “New Proposed Regulations Would Affect the Taxation of Foreign Investors in U.S. Real Estate,” available here. Portions of the Proposed Regulations addressing Section 892 of the Internal Revenue Code are expected to be addressed in a separate rulemaking.

[2] IRS, Private Letter Ruling, PLR 9630016.

This communication is issued by Schulte Roth & Zabel LLP for informational purposes only and does not constitute legal advice or establish an attorney-client relationship. In some jurisdictions, this publication may be considered attorney advertising. © 2024 Schulte Roth & Zabel LLP. All rights reserved. SCHULTE ROTH & ZABEL is the registered trademark of Schulte Roth & Zabel LLP.