Alerts

FTC Increases 2025 Thresholds for HSR Filings and Interlocking Directorates

January 13, 2025

On Jan. 10, 2025, the Federal Trade Commission (“FTC”) announced increased reporting thresholds under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (“HSR Act”) and an amended HSR filing fee schedule. The revised HSR thresholds and filing fee schedule will apply to all transactions that close on or after Feb. 21, 2025. The minimum size-of-transaction threshold was increased from $119.5 million to $126.4 million. Acquisitions below this threshold will not be reportable.

The FTC also raised the thresholds for interlocking directorates under Section 8 of the Clayton Act, effective as of Jan. 22, 2025, and increased the maximum civil penalty for HSR violations to $53,088 per day of noncompliance, effective as of Jan. 17, 2025.

Revised HSR Act Thresholds

Generally, the HSR Act requires parties to acquisitions of voting securities, assets or non-corporate interests meeting certain thresholds to make a premerger notification to the FTC and the Antitrust Division of the Department of Justice (“DOJ”) unless an exemption applies. The parties to a reportable transaction must observe a waiting period (generally 30 days) before closing. The HSR Act thresholds are adjusted annually in accordance with changes in US gross national product (“GNP”).

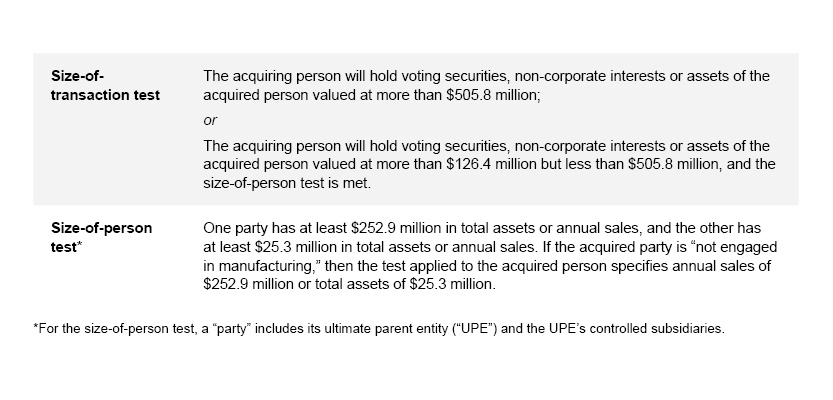

Under the revised thresholds, transactions valued up to and including $126.4 million are not reportable under the HSR Act. Transactions valued at more than $126.4 million may be reportable if they meet the following criteria and no exemption applies:

HSR notification thresholds for acquisitions of voting securities. After an HSR filing has been made, and the applicable waiting period has expired or been terminated, any additional acquisitions by the same acquiring person of the same issuer’s voting securities will be exempt from HSR notification, so long as:

- The acquiring person’s holdings crossed the notification threshold with respect to which the premerger notification was made within one year of the expiration or early termination of the HSR Act waiting period; and

- The subsequent acquisition is consummated within five years following the expiration or early termination of the HSR Act waiting period; and

- The subsequent acquisition will not meet or exceed a higher notification threshold (based on the adjusted thresholds in effect at the time of consummation).

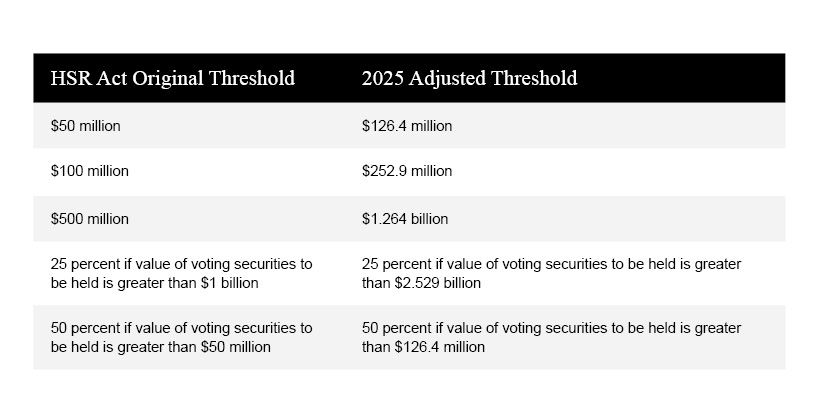

The following adjusted notification thresholds take effect as of Feb. 21, 2025:

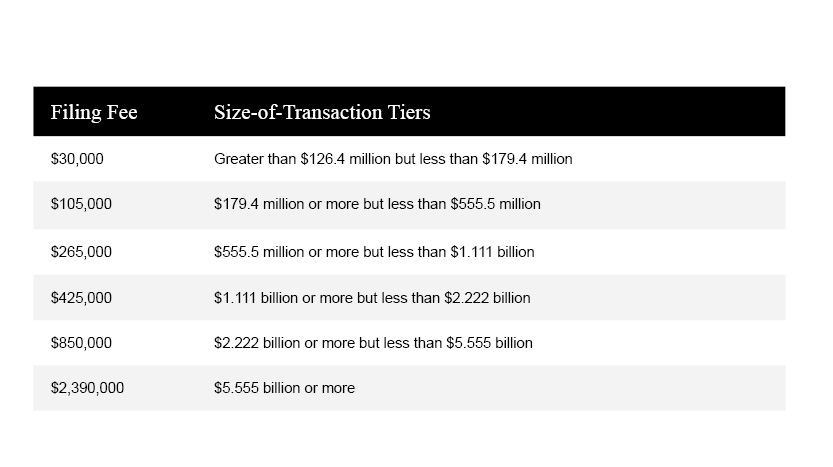

HSR filing fees. The current filing fee schedule, which becomes effective on Feb. 21, 2025, is as follows:

The filing fees are increased annually (and rounded to the nearest $5,000) if the percentage increase in the Consumer Price Index (“CPI”) since the last fiscal year is greater than one percent. The size-of-transaction tiers are adjusted annually based on the percentage change in GNP compared to the prior fiscal year.

HSR penalties. Any person (including the company and any of its officers, directors or partners) failing to comply with the HSR Act may be subject to a civil penalty for each day during which such person is in violation of the Act. The maximum civil penalty was increased from $51,744 per day to $53,088 per day of noncompliance, effective as of Jan. 17, 2025. The civil penalty amounts are adjusted by the FTC annually based on the percentage change in the CPI.

Revised Thresholds for Interlocking Directorates

The FTC also revised the thresholds for evaluating interlocking directorates, effective as of their date of publication in the Federal Register. Under certain circumstances, Section 8 of the Clayton Act prohibits one person from simultaneously serving as a director or officer of two competing corporations if each corporation has capital, surplus and undivided profits aggregating more than $51,380,000 (up from $48,559,000).

The Clayton Act does not prohibit the interlock if: (1) the competitive sales of either corporation are less than $5,138,000 (up from $4,855,900); (2) the competitive sales of either corporation are less than two percent of that corporation’s total sales; or (3) the competitive sales of each corporation are less than four percent of that corporation’s total sales.

Although Section 8 technically applies only to corporations, both the DOJ and the FTC have taken the position that their broader antitrust authority allows them to enforce the same concept against non-corporate entities.

Authored by Peter Jonathan Halasz and Ngoc Pham Hulbig.

If you have any questions concerning this Alert, please contact your attorney at Schulte Roth & Zabel or one of the authors.

This communication is issued by Schulte Roth & Zabel LLP for informational purposes only and does not constitute legal advice or establish an attorney-client relationship. In some jurisdictions, this publication may be considered attorney advertising. © 2025 Schulte Roth & Zabel LLP. All rights reserved. SCHULTE ROTH & ZABEL is the registered trademark of Schulte Roth & Zabel LLP.