Alerts

Decoding the Final HSR Changes: What Investment Funds Should Know

October 28, 2024

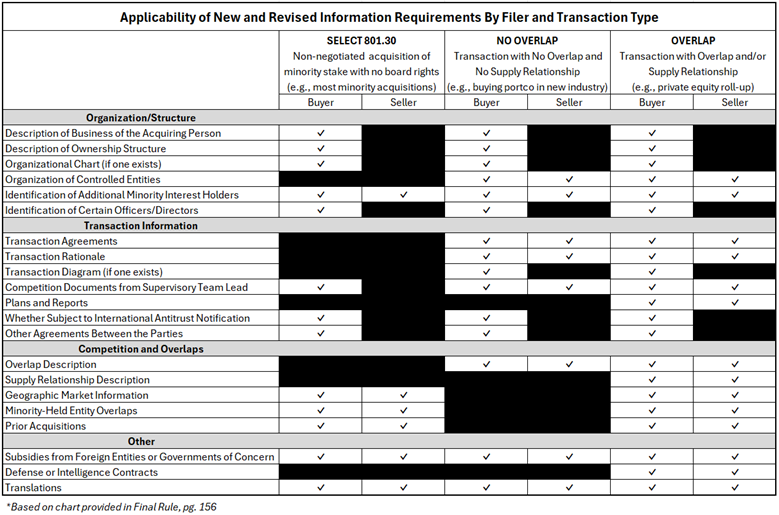

Nature of Transaction Determines Level of Increased HSR Filing Burden

On Oct. 10, 2024, the Federal Trade Commission (“FTC” or the “Commission”) — with the concurrence of the Antitrust Division of the US Department of Justice (“DOJ”) — announced the FTC’s unanimous, bipartisan vote to adopt a final rule implementing the most significant changes to the Hart-Scott-Rodino Act (“HSR”) premerger notification rules in the HSR program’s 45-year history (the “Final Rule”). Although nowhere near as sweeping and burdensome as the original proposed changes (on which we wrote in 2023), the changes will meaningfully increase the time and effort required to prepare HSR filings for all reportable transactions.

For investment funds (and any other filers), the magnitude of the increased burden will vary with the potential antitrust risks raised by the transaction type.

The lowest tier of risk, with the corresponding lowest HSR information requirements, is for “select 801.30 transactions,” in which a fund is acquiring securities from a third party or on the open market and will not gain control or board rights. Passive investors acquiring more than 10 percent of an issuer, as well as most investors who engage, or seek to engage, with management would fall into this category. The next tier of antitrust risk, for transactions in which the parties do not have operations in the same industry or any business relationship, has more HSR disclosure requirements. This category includes a private equity firm’s acquisition of a portfolio company in an industry in which the firm currently has no presence. Activist investors seeking board rights, which typically do not have controlling stakes in operating companies or do not focus on a particular industry, also may fall into this middle tier. The highest tier of risk, with the most burdensome HSR information requirements, is for transactions in which the parties operate in the same industry or have a business relationship, such as a private equity firm buying a company as part of a “roll-up” strategy. Within each category of transactions, more information is required from buy-side filers than from the sell-side.

The FTC notes that the time required to prepare an HSR filing will vary significantly based on the type of filing, “with filings that are more likely to raise antitrust risk requiring higher hours.” The Commission estimates (and many practitioners believe it substantially underestimates) that the average number of additional hours required to prepare an HSR filing under the final rule is 68 hours, with an average low of 10 additional hours for select 801.30 transaction filings by the acquired person and an average high of 121 additional hours for filings from the acquiring person in a transaction with overlaps or supply relationships.

Unless challenged, the final rule is expected to become effective in the first quarter of 2025, 90 days after its publication in the Federal Register. At that time, the FTC also will lift its “temporary” suspension (since February 2021) of the granting of early termination of the HSR waiting period for transactions that do not raise significant antitrust concerns.

Select 801.30 Transactions

Under the HSR Rules, 801.30 transactions are non-negotiated transactions, such as tender offers and acquisitions on the open market or from third parties. Recognizing the low risk that these transactions pose antitrust issues, the Final Rule introduces a new category of “select 801.30 transactions” for which fewer information requirements are imposed. These transactions also should benefit from the reinstatement of early termination.

A select 801.30 transaction is one in which (1) the acquisition would not confer control, (2) there is no agreement (or contemplated agreement) between the buyer and seller and (3) the acquiring person does not have and will not obtain any right to serve as, appoint, veto, or approve board members, or members of any similar body, of any entity within the acquired person or the general partner or management company of any entity within the acquired person. For example, the acquisition of a non-controlling minority stake of more than 10 percent on the open market by a passive investor with no other ties to the issuer is a select 801.30 transaction. In addition, minority acquisitions by investors engaging or seeking to engage with management, such that they could not rely on the investment-only exemption, would fall into this tier (although investments by activists seeking board rights may be excluded depending on the specifics of the transaction). Executive compensation transactions also qualify as select 801.30 transactions.

The new HSR form will require substantial additional disclosures from investors making an HSR filing for select 801.30 transactions, but they are significantly less burdensome than the information that will be required for other types of transactions. The new and revised information requirements for select 801.30 transactions include:

- Description of the fund’s business

- Description of the fund’s ownership structure

- Organizational chart (if one exists)

- Identification of additional minority holders in the organizational chain

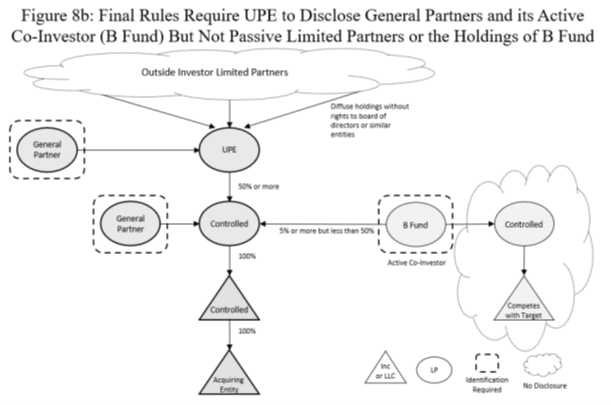

The current form requires disclosure of the holders of 5 percent or more in the ultimate parent entity (“UPE”) and the acquiring entity. Minority holders of intermediate entities in the investment chain do not have to be disclosed and only the general partner must be disclosed for limited partnerships.

The new form requires disclosure of minority holders (including any trade names under which the holders do business) of 5 percent or more in the acquiring entity, any entity controlling or controlled by the acquiring entity, and any entity that will be created and controlled by the acquiring person to effectuate the transaction (each a “Covered Entity”). If the Covered Entity is a limited partnership, the filer must provide the required information for: (1) its general partner, regardless of the percentage held, and (2) limited partners that (i) hold or will hold 5 percent or more of the partnership, and (ii) have or will have management rights with regard to any Covered Entity or the general partner or management company of any Covered Entity. Management rights are defined as the right to serve as, nominate, appoint, veto or approve board members or individuals with similar responsibilities. Passive limited partners with no management rights do not need to be disclosed.

The Final Rule contains the following diagram illustrating the disclosure requirements for limited partners. (Under the current rules, only the general partner of the UPE would need to be disclosed.)

- Identification of certain officers and directors (responses to this item will assist the agencies in identifying director interlocks that may violate Section 8 of the Clayton Act)

The fund must list all of the officers and directors (or individuals exercising similar functions) of any Covered Entity, as well as those who are likely to serve in one of these positions, who also serve as the officer or director of another entity that operates in the same business or industry as the target, and identify those entities.

For entities within the acquiring person responsible for the development, marketing, or sale of overlapping products or services, identify the current officers or directors (or individuals exercising similar functions) and those who have served in one of these positions within the three months before filing that also serve as an officer or director of another entity that operates in the same business or industry as the target.

- Expansion of Competition Documents

The scope of “Competition Documents,” formerly known as Item 4(c) and 4(d) documents, has been expanded beyond documents prepared by or for officers or directors to now include documents prepared by or for the “supervisory deal team lead,” defined as the individual primarily responsible for supervising the strategic assessment of the deal who is not an officer or director. (If the individuals supervising the strategic assessment of the deal are already either an officer or director, filers may state that this is the case on the form.)

Filers also should submit any draft Competition Documents that were shared with any member of the board of directors (or similar body). For noncorporate investment funds, this requirement may result in a large number of documents if a member of the deal team also is a member of the “similar body.”

- Translations for foreign-language documents

- Whether the fund has (or within one year of filing, had) certain types of agreements with the target, including any agreements with non-compete or non-solicitation terms, licensing agreements, and supply agreements

- Jurisdictions in which a non-US antitrust or competition authority has been or will be notified of the transaction

- Subsidies received within the last two years from “foreign entities or governments of concern,” as defined by 42 U.S.C. 18741(a)(5)(C), which currently includes China, Iran, North Korea, and Russia

Transactions with no overlaps or supply relationships

The next step up from select 801.30 transactions in terms of new and revised information requirements is for transactions in which the parties do not have any overlaps or supply relationships. This includes acquisitions by agreement between the parties (e.g., a private equity firm acquiring a company that does not compete with or have any supply relationships with the firm’s other portfolio companies), as well as certain acquisitions by activists seeking board rights.

An investment fund on the buy-side of a transaction with no overlaps or supply relationships must provide all of the information required for select 801.30 transactions listed above, as well as:

- Organization of controlled entities in investment structure by operating company or operating business (“top-level entity”), including all trade names under which the entities do business

- Brief description of transaction rationale(s)

The description must identify each document included with the filing that supports the rationale(s). If documents provide inconsistent rationales, filers should address those inconsistencies.

- Full transaction agreements, including exhibits, schedules and side letters (but excluding “clean team” agreements)

- Transaction diagram (if one exists)

- Overlap description (global, not limited to the US)

The filer must describe each of its principal categories of products and services (as they generally are described in its ordinary course business documents).

Transactions involving overlaps or supply relationships

The last category, for transactions involving overlaps or supply relationships, presents more potential antitrust risks than the first two (select 801.30 transactions and transactions with no overlap or supply relationships) and so is saddled with the most onerous burden in terms of new and revised HSR information requirements. If these transactions are subjected to an in-depth investigation, the Final Rule notes that “the additional information contained in the HSR filing will allow the Agencies to focus their investigation on those aspects of the transaction that create antitrust risk, and minimize ‘overly broad’ Second Requests [that can] impose unnecessary costs and delays.” A private equity firm’s acquisition of a company as part of its roll-up strategy would fall into this category of transactions.

In addition to all of the information requirements listed in the above two sections, funds filing on the buy-side of a transaction involving overlaps or supply relationships between the parties must provide:

- Overlap description (global, not limited to the US)

The filer must describe each of its principal categories of products and services (as they generally are described in its ordinary course business documents).

In addition, the filer must list and briefly describe each of its current or known planned products or services that competes with (or could compete with) a current or known planned product or service of the target. Known planned products or services may be limited to those referenced in any document submitted with the filing and should reflect only the filer’s knowledge of the other party’s business (i.e., the parties should not exchange information for the purpose of answering this item).

For each listed product or service currently being sold, the filer must: (1) provide sales for the most recent year (or provide metrics to measure performance if not by revenue); (2) describe the categories of customers that use that product or service; (3) provide the top 10 customers in the most recent year by total sales and (4) provide the top 10 customers for each customer category identified.

For each listed product or service that is not yet generating revenue, the filer must: (1) provide projected revenue, estimated unit sales, estimated service use, or any metric to measure performance; (2) provide the date that product or service development began; (3) describe the current stage of development; (4) the date that development was or will be completed, including testing and regulatory approvals and (5) the date that the product or service is expected to be sold or otherwise commercially launched.

- Supply relationships description (global, not limited to the US)

The filer must list and describe each product, service or asset (including data) representing at least $10 million in sales in the most recent year that are (1) sold to or purchased from the other party, or (2) sold to or purchased from a business that competes with the other party or that uses the product or service as an input to compete with the other party. The response should reflect only the filer’s knowledge (i.e., the parties should not exchange information for the purpose of answering this item).

For each listed product, service or asset, the filer also must provide sales data for the most recent year and the top 10 customers (for sales) or suppliers (for purchases).

- Regularly prepared strategic documents (“Plans and Reports”) provided to CEOs and all Plans and Reports provided to Boards of Directors within a year of filing that discuss market shares, competition, competitors, or markets for any overlapping product or service

- Pending or awarded defense or intelligence procurement contracts generating more than $100 million of revenue that relate to an overlap between the parties

Other notable changes

- Separate forms. Acquiring persons and acquired persons will file using different forms. The HSR form for the sell-side is shorter and requires less information than the form for the buy-side.

- Letter of Intent. Parties may still file on the basis of a non-definitive agreement, such as an LOI, but the dated document must include “some combination of the following terms: the identity of the parties; the structure of the transaction; the scope of what is being acquired; calculation of the purchase price; an estimated closing timeline; employee retention policies, including with respect to key personnel; post-closing governance; and transaction expenses or other material terms.” The filer also must attest in the HSR filing certification that the document includes sufficient detail about the transaction’s scope.

- Rollover investors. Minority investors of 5 percent or more in the acquired entity must be disclosed if their investments will “roll over” post-consummation.

- Minority holdings. Parties must list only minority investments held in entities that are in an overlapping business (i.e., filers no longer have the option to list all minority-held entities).

- Prior acquisitions by acquired entity. Like the acquirer, the target now must disclose its prior acquisitions in the last five years of entities with revenues in overlapping products or services. (This requirement is aimed at helping the agencies identify strategic “roll-up” transactions.)

- Geographic market information. The Final Rule updates the lists of industry codes requiring street-level information versus state-level information for the parties’ operations (including franchisees’ operations) in overlapping areas of business.

- Online portal. The FTC created an online portalfor the public and other interested parties to submit comments related to transactions under review.

(It could have been worse!)

Although HSR filings under the final rule will require significantly more time to prepare, the new and revised information requirements are quite curtailed compared to the full body of information and documents envisioned in the original proposed changes. Some of the more burdensome—and controversial—proposals that were dropped include:

- Disclosure of all minority limited partner investors holding 5 percent or more, including those without management rights

- Detailed board observer information

- Requiring drafts of all transaction-related documents, including confidential information memoranda and other deal documents evaluating competition

- Expanding the disclosure requirement for prior acquisitions to include all entities in the last 10 years with no minimum size requirement, which would have been particularly onerous for firms engaged in serial or “roll-up” transactions

- Narrative explanation of the deal timeline

- Creation of organizational charts that included the authors of documents submitted with the HSR filing

- Information about interest holders that might have material influence on the acquiring person’s management or operations (e.g., creditors, investors with board rights)

- Detailed disclosures about labor markets and employees

- Geolocation data for locations of certain overlapping products and services

- Information about steps taken to preserve documents and use of messaging systems

- Providing “formerly known as” (“f/k/a”) information for relevant entities

Key Takeaways

- Final changes are extensive and will apply to all HSR filers. The changes to the HSR framework affect filers in all reportable deals, with the lightest burden on simple transactions (e.g., open market purchases) and the greatest lift borne by parties to transactions involving overlapping products or services or supply relationships (e.g., serial or “roll up” acquisitions).

- Suspension on early termination lifted. The FTC will begin granting early termination once the final rule becomes effective. Given that the additional required information will provide the FTC and DOJ with more insight into the proposed transaction earlier in the process, the agencies expect to be able to complete their review of transactions raising little to no antitrust risk more efficiently.

- Extensive additional lead time required for HSR preparation. In terms of average hours required to prepare HSR filings, the FTC has estimated (and likely significantly underestimated) a minimum average of additional 10 hours for the most simple HSR filings up to 121 hours for acquirers transactions involving overlaps or supply relationships. Buyout firms will need to build sufficient time into their deal timetable to prepare HSR filings and should consider extending purchase agreement commitments to submit filings beyond the customary 5 to 10 business days (perhaps to “as promptly as practicable,” at least for the first HSR filing to be submitted by a particular filer).

- Consider filing before the final rule becomes effective in January 2025. If parties are planning to sign the transaction in the near term, they should consider accelerating the HSR timetable to file under the current rules, including whether it may be appropriate to make an HSR filing based on a letter of intent or term sheet.

- Mitigation of risks needed for document creation. Parties will need to be mindful about wording and perceptions when preparing documents, including ordinary course documents discussing competition sent to the CEO and board of directors that may be prepared months before an HSR filing will be submitted. Care should be taken to avoid, for example, defining a “market” (as it may limit or be inconsistent with how a market may be defined in a competitive analysis), overstating a party’s competitive significance, or using “buzz words” that tend to interest antitrust regulators (e.g., “dominate,” “control,” “leverage,” etc.).

- Set up a framework to gather and maintain HSR information. Parties can begin collecting and maintaining information that must be provided in HSR filings (e.g., information relating to fund structure, minority investors, third-party positions held by officers and directors, etc.).

Authored by Peter Jonathan Halasz and Ngoc Pham Hulbig.

If you have any questions concerning this Alert, please contact your attorney at Schulte Roth & Zabel or one of the authors.