Alerts

Changes to ERISA’s QPAM Exemption and Fiduciary Rule

June 26, 2024

In recent weeks, the US Department of Labor (“DOL”) has taken significant regulatory and administrative actions affecting how investment advisers manage and advise employee benefit plans subject to the Employee Retirement Income Security Act of 1974, as amended (“ERISA”) and individual retirement accounts (“IRAs”). In early April, the DOL issued final amendments to its “Qualified Professional Asset Manager” (“QPAM”) Exemption, a prophylactic prohibited transaction class exemption utilized by investment advisers managing assets of ERISA plans and IRAs. The DOL followed up in late April with a new fiduciary rule that expands the definition of who is or becomes an ERISA fiduciary by providing investment advice with respect to ERISA plans and IRAs (“New Fiduciary Rule”), along with amendments to related prohibited transaction exemptions.

The QPAM Exemption has been amended by the DOL several times since it became effective in 1984; however, the new amendments (“QPAM Amendments”), which became effective on June 17, 2024, are some of the most significant changes to the exemption. Those changes may encourage some asset managers to explore other applicable prohibited transaction exemptions.

The New Fiduciary Rule replaces a rule that was issued in 1975. However, if the New Fiduciary Rule seems familiar, it is because the DOL has been trying to broaden the definition of fiduciary under ERISA since 2010. In fact, the DOL issued a revised fiduciary rule in 2016 that was subsequently vacated in 2018 by the US Court of Appeals for the Fifth Circuit. The New Fiduciary Rule might suffer the same fate as its 2016 predecessor. Fortunately, the New Fiduciary Rule should have minimal impact on asset managers, even if it survives in its current form.

An appendix to this Alert labeled “Action Items to Address New ERISA Rules” describes certain steps that should be taken to address the QPAM Amendments and the New Fiduciary Rule.

QPAM Exemption

If the conditions of the QPAM Exemption are met, a QPAM may cause an ERISA plan or IRA, directly or through a separately managed account, fund-of-one or pooled fund that holds ERISA plan assets – commonly referred to as a “plan asset fund”[1] – to enter into a transaction with “parties in interest” with respect to the plan or plans that have invested in the fund that otherwise would have been prohibited by ERISA. To rely on the QPAM Exemption, with respect to any Plan, various conditions must be satisfied at the time of the transaction, including:

- Neither the party in interest nor any of its affiliates can have the power to hire or fire the QPAM or to negotiate the terms of the QPAM’s management agreement; however, if the transaction involves a plan asset fund with multiple unrelated plan investors, this requirement is met if no single Plan, when aggregated with all other Plans sponsored by the same employer (or affiliated group of employers), represents 10 percent or more of the fund’s assets;

- The counterparty cannot be a party in interest with respect to a Plan or Plans of the same employer whose assets constitute 20 percent or more of the QPAM’s total assets under management across all of its funds and accounts;

- The party in interest cannot be the QPAM itself, or any of its affiliates; and

- At the time the transaction is entered into (and at the time of any subsequent renewal or modification that requires the consent of the QPAM), the terms of the transaction must be at least as favorable to the Plan as the terms generally available in arm’s-length transactions between unrelated parties.

QPAM Amendments

QPAM Independence

The QPAM Amendments clarify that a QPAM must exercise its own independent judgement with respect to a transaction. A QPAM cannot be hired simply to approve a pre-negotiated deal between the transaction’s parties. Where a QPAM shares investment responsibilities, such as in a sub-advisory relationship, each transaction must clearly identify which entity is exercising control over the transaction and acting as a QPAM (for example, who is acting as the QPAM in connection with entering into a Master ISDA Agreement and who is acting as the QPAM in effecting specific transactions under the Master ISDA Agreement).

Dollar Thresholds

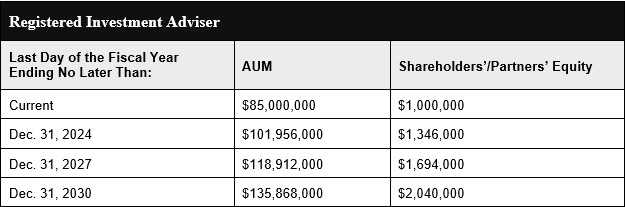

Only certain banks, insurance companies and investment advisers are eligible to act as a QPAM. With respect to an investment adviser, the adviser must be registered under the Investment Advisers Act of 1940 and meet dollar thresholds imposed by the exemption for total client assets under its management and control (“AUM”), measured as of the last day of its most recent fiscal year, and shareholders’ or partners’ equity (or the payment of the investment adviser’s liabilities must be guaranteed by certain entities having equity equal to the threshold imposed by the exemption). As shown in the table below, the QPAM Amendments increase those dollar thresholds over the next six years:

After 2030, the DOL will make subsequent annual adjustments to reflect inflation.

Disqualification

An asset manager – whether an investment adviser, bank or insurance company – cannot act as a QPAM if, within the 10 years prior to a transaction, the asset manager or any of its “affiliates” (discussed below) has been convicted of, or released from prison as a result of a conviction in respect of, a broad range of felonies involving the misuse of money (e.g., theft, extortion, forgery, misappropriation of funds). The QPAM Amendments clarify and expand the types of convictions and other misconduct that disqualify an asset manager from utilizing the QPAM Exemption regardless of whether the asset manager was directly involved in, or had any knowledge of, the “bad acts.”

The QPAM Amendments generally define a “Criminal Conviction” as a conviction in a US or state court in respect of certain crimes,[2] as well as a criminal conviction by a foreign court, regardless of how the applicable foreign jurisdiction classifies the crime (e.g., felony, etc.), if the foreign crime is substantially equivalent to one of the US criminal offenses listed in the QPAM Exemption. However, a conviction in a foreign country that has been identified as a “foreign adversary” by the US Department of Commerce is excluded as a Criminal Conviction under the QPAM Exemption.

In addition to actual convictions, the QPAM Amendments disqualify an asset manager from serving as a QPAM if the asset manager or any of affiliate has engaged in a new category of misconduct, referred to as “Prohibited Misconduct.” In general, Prohibited Misconduct includes entering into a non-prosecution (“NAP”) or deferred prosecution agreement (“DPA”) on or after June 17, 2024, with a US federal or state prosecutor’s office or regulatory agency, where the factual allegations that form the basis for the NAP or DPA would have constituted a Criminal Conviction if they were successfully prosecuted. Prohibited Misconduct also includes conduct that is determined in a final judgment or court-approved settlement by a US or state criminal or civil court, in a proceeding brought by certain US (including the DOL) or state authorities that involves:

- Engaging in a systematic pattern or practice of conduct that violates the conditions of the OPAM Exemption in connection with otherwise non-exempt prohibited transactions;

- Intentionally engaging in conduct that violates the conditions of the QPAM Exemption in connection with otherwise non-exempt prohibited transactions; or

- Providing materially misleading information to the DOL or certain other US or state authorities in connection with the conditions of the QPAM Exemption.

Importantly, the QPAM Exemption defines an “affiliate” broadly, and in a manner that, with respect to any asset manager, would include: (1) any person directly or indirectly through one or more intermediaries, controlling, controlled by, or under common control with the asset manager; (2) any director of, relative of or partner in, the asset manager; (3) any corporation, partnership, trust or unincorporated enterprise of which such person is an officer, director, or is a five percent or more partner or owner; and (4) any employee or officer of the asset manager who (a) is a highly compensated employee or officer (earning 10 percent or more of the yearly wages of the asset manager); or (b) has direct or indirect authority, responsibility, or control regarding the custody, management or disposition of plan assets. In turn, the QPAM Exemption defines “control” as the power to exercise a controlling influence over the management or policies of a person other than an individual. Accordingly, an “affiliate” of an asset manager includes parent entities and subsidiaries and may include a portfolio company controlled directly by the asset manager or indirectly through a fund managed by the asset manager.

If an asset manager becomes disqualified from acting as a QPAM because of a Criminal Conviction or Prohibited Misconduct, the asset manager will be unable to rely on the QPAM Exemption; however, the asset manager may be able to rely on the QPAM Exemption solely with respect to its existing Plan clients during a one-year transition. For the one-year transition period to apply, the asset manager must notify, in writing, the DOL and each of its Plan clients of the facts surrounding the conduct that disqualified the asset manager. In particular, the notice must provide an objective description of the facts and circumstances of the Criminal Conviction or Prohibited Misconduct that contains sufficient detail to fully inform the applicable Plan’s fiduciaries (in the case of a plan asset fund, the fiduciaries of the Plans invested in the fund) of the nature and severity of the conduct in order to enable the fiduciary to satisfy its duties with respect to hiring, monitoring, evaluating and retaining the asset manager in a non-QPAM capacity.

The asset manager must also notify its Plan clients that, during the one-year transition period, the asset manager:

- Will not restrict the ability of the Plan client to terminate or withdraw from its arrangement with the asset manager (which includes redeeming from a plan asset fund);

- Will not impose any fees, penalties or charges on the Plan client in connection with the process of terminating or withdrawing (other than certain fees designed to protect against abusive investment practices or protect other investors in plan asset funds);

- Will indemnify the Plan client for actual losses (including losses and related costs arising from unwinding transactions with third parties and transitioning to a different asset manager), resulting from the current asset manager becoming disqualified; and

- Will not employ or knowingly engage any individual that participated in the Criminal Conviction or Prohibited Misconduct.

DOL Notice

The QPAM Amendments also impose new notice and recordkeeping requirements. To qualify as a QPAM, an asset manager must notify the DOL by sending an email to QPAM@dol.gov providing the legal name of each entity relying on the QPAM Exemption and any name under which the QPAM may be operating. A QPAM must send its email notification to the DOL within 90 calendar days after relying on the QPAM Exemption or changing its legal or operating name. An asset manager that is relying on the QPAM Exemption as of the effective date of the QPAM Amendments must send its email notice to the DOL by no later than Sept. 15, 2024.

Absent a change to its legal or operating name or ceasing to rely on the exemption, the email notification must be made only once and need not name any particular plan or fund, nor any specific transaction or any particular point in time when the asset manager is engaging in transactions in reliance on the QPAM Exemption. An asset manager that inadvertently fails to meet the deadline for sending its email notice to the DOL may cure its failure by sending the email notice within 180 calendar days; however, the late notice must include an explanation for failing to meet the 90 calendar day deadline. A QPAM may also notify the DOL at any time if it is no longer relying upon the QPAM Exemption.

Recordkeeping

The QPAM Amendments require that, with respect to any transaction for which a QPAM relied on the QPAM Exemption, the QPAM must maintain records to show that the conditions of the QPAM Exemption have been met. The records must be reasonably available for inspection, for a period of six years, at the QPAM’s customary location during normal business hours, by constituents of Plan clients, consisting of:

- Any authorized employee of the DOL or the Internal Revenue Service or another US or state regulator;

- Any fiduciary of an ERISA plan or IRA managed by the QPAM or that has invested in a plan asset fund managed by the QPAM;

- Any contributing employer and any employee organization whose members participate in an ERISA plan managed by the QPAM or that has invested in a plan asset fund managed by the QPAM; or

- Any participant or beneficiary of an ERISA plan or IRA managed by the QPAM or that has invested in a plan asset fund managed by the QPAM.

In the preamble to the QPAM Amendments, the DOL stated that the new recordkeeping requirements are not intended to require transaction by transaction recordkeeping. Instead, the DOL indicated that the requirement should be satisfied, for example, if records are retained that demonstrate that the asset manager met the QPAM Exemption’s net worth and assets under management conditions at the time of a particular transaction and that the asset manager was unrelated and independent from the applicable parties in interest involved in the transaction (discussed above). In addition, a QPAM is not required to disclose to Plan constituents (except for government authorities) its trade secrets, commercial or financial information or records regarding any fund in which the applicable Plan client is not invested. Nevertheless, a QPAM must explain, in a written notice to a requesting Plan constituent, the reason why the QPAM has not provided information. If the new recordkeeping requirements are not satisfied, only the QPAM, and not other parties, may be subject to a civil penalty assessed under ERISA or excise taxes imposed under the Internal Revenue Code of 1986, as amended. However, the loss or destruction of required records due to circumstances beyond the control of the asset manager will not cause the applicable transaction to lose its reliance on the QPAM Exemption.

Potential Use of Other Prohibited Transaction Exemptions

While the QPAM Exemption has long served as the “gold standard” of ERISA exemptions, other prohibited transaction exemptions now exist to cover most, if not all, of the transactions covered by the QPAM Exemption. Given the additional requirements imposed under the QPAM Exemption, we anticipate that asset managers will consider shifting their reliance from the QPAM Exemption to those alternative exemptions, such as ERISA’s “Service Provider Exemption” (also referred to as “408(b)(17)” – the applicable section of ERISA) and “Necessary Services Exemption” (also referred to as “408(b)(2)” – the applicable section of ERISA).

New Fiduciary Rule

The New Fiduciary Rule expands the category of persons who are considered a fiduciary by providing investment advice to a “Retirement Investor” – a category of investor that covers (1) any ERISA plan as well as its participants (and participants’ beneficiaries) and fiduciaries and (2) any IRA as well as the IRA owner (and IRA owner’s beneficiaries) and the IRA’s fiduciaries.

The New Fiduciary Rule addresses the circumstances under which a person who does not exercise investment discretion over plan assets will be considered a fiduciary as a result of providing an investment recommendation to a Retirement Investor. The New Fiduciary Rule refers to such a fiduciary as an “investment advice fiduciary” and focuses on investment recommendations regarding:

- The advisability of acquiring, holding, disposing of, or exchanging, securities or other investment property, or an investment strategy;

- How securities or other investment property should be invested after the securities or other investment property are rolled over, transferred, or distributed from an ERISA plan or IRA;

- The management of securities or other investment property, including recommendations on investment policies or strategies, portfolio composition, selection of other persons to provide investment advice or investment management services, selection of investment account arrangements (e.g., account types such as brokerage versus advisory) or voting of proxies; and

- The rolling over, transferring, or distributing assets from an ERISA plan or IRA, including recommendations as to whether to roll over, transfer or take a distribution and the amount, the form and the destination of such a rollover, transfer or distribution.

An investment recommendation, alone, will not give rise to fiduciary status. Under the New Fiduciary Rule, a person will be an Investment Advice Fiduciary with respect to a Retirement Investor only if: (1) the person, either directly or through affiliates, makes professional investment recommendations to investors on a regular basis as part of their business and (2) the investment recommendation to the Retirement Investor:

- Is provided for a fee or other compensation, direct or indirect;

- Is made under circumstances that would indicate to a reasonable investor in like circumstances that the recommendation;

- Is based on review of the Retirement Investor’s particular needs or individual circumstances,

- Reflects the application of professional or expert judgment to the Retirement Investor’s particular needs or individual circumstances, and

- May be relied upon by the Retirement Investor as intended to advance the Retirement Investor’s best interest.

Alternatively, even if the criteria above is not met, a person will be considered a fiduciary under the New Fiduciary Rule by representing or acknowledging to the Retirement Investor that it is acting as an ERISA fiduciary. In contrast, however, the New Fiduciary Rule expressly provides that written disclaimers, alone, may be ineffective in avoiding fiduciary status as an Investment Advice Fiduciary.

Importantly, the New Fiduciary Rule makes clear that marketing and sales communications will not give rise to fiduciary status under ERISA. As an example, the New Fiduciary Rule provides that a recommendation to a Retirement Investor, made in connection with marketing, to purchase a particular investment or pursue a particular investment strategy will not give rise to an ERISA fiduciary relationship if the other conditions are not met and no inconsistent representation or acknowledgment is made indicating that the recommendation is being made by an ERISA fiduciary.

Action Items to Address New ERISA Rules

QPAM Exemption

- If a fund is designed to be a non-plan asset fund (i.e., it does not hold ERISA “plan assets”), no action is necessary. The fund is not a plan asset fund, the fund’s transactions are not subject to ERISA and, therefore, the asset manager does not rely on the QPAM Exemption (or any other prohibited transaction exemption) with respect to any aspect of the management of the fund.

- No action is necessary even if the manager has agreed in a side letter or other document that it would be a QPAM if the fund were to become a plan asset fund unless the fund actually becomes a plan asset fund.

- If an asset manager reserves the right in governing fund documents to allow a fund to become a plan asset fund (a “Springing QPAM”), but the fund is not currently a plan assets fund and the manager does not foresee it becoming a plan asset fund, consideration should be given to revising the fund’s governing documents to remove the ability of the fund to become a plan asset fund.

- If a fund is not currently a plan asset fund, but such flexibility is desired, consider adopting an internal process that must be followed prior to the fund becoming a plan asset fund due to inflows or outflows. No filing of a QPAM notice with the DOL is necessary if the fund is not currently a plan asset fund.

- With respect to any plan asset fund (including any plan asset fund of funds) or any separately managed account or fund-of-one of an ERISA plan:

- To comply with the QPAM Exemption’s new DOL notice requirement, send the required email to the DOL, addressed to QPAM@dol.gov, by Sept. 15, 2024. The email need only include the following statement:

- This email serves to notify the US Department of Labor that [insert name of asset manager and any names under which the asset manager may be operating] intends to rely on Prohibited Transaction Exemption 84-14 as a “QPAM.”

- Review applicable trading documents and prime brokerage agreements to determine whether they require that transactions be effected solely in compliance with the QPAM Exemption or, whether they permit use of the Service Provider Exemption as an alternative. If no alternative language is included, consider renegotiating the trading documents to permit the asset manager to rely on the Service Provider Exemption.

- Determine what steps, if any, need to be undertaken before Dec. 31, 2024 to ensure that the manager satisfies the new assets under management and shareholder’s/partner equity thresholds and prepare a balance sheet to be used to show such compliance.

- To comply with the QPAM Exemption’s new DOL notice requirement, send the required email to the DOL, addressed to QPAM@dol.gov, by Sept. 15, 2024. The email need only include the following statement:

- With respect to clients that are neither ERISA plans or IRAs nor funds designed not to be plan assets funds, review all investment management agreements and side letters to determine whether the manager has committed contractually to qualifying as a QPAM. Such a commitment is sometimes agreed to by a manager with respect to a governmental plan investor and/or a Taft Hartley (i.e., union) pension plan. Typically, those provisions only require the asset manager to be subject to the standard of care and do not mention QPAM.

- With respect to any asset manager relying on, or who may rely on, the QPAM Exemption, adopt procedures to ensure that, in addition to developments affecting the asset manager itself, any five percent owner of the asset manager or any “affiliate” of the asset manager provides to the asset manager advance notice of any developments (i.e., a Criminal Conviction or Prohibited Misconduct) by such five percent owner or affiliate that could result in the disqualification of the asset manager to act as QPAM.

- The procedures should be communicated to each five percent owner and affiliate and considered in connection with the transaction involving the asset manager, any of its affiliates or managed funds.

- Adopt written procedures to ensure that appropriate due diligence is conducted before there is a purchase or sale of equity in an asset manager relying on the QPAM Exemption or in the parent of such asset manager to determine if such transaction could result in the disqualification of the asset manager to act as QPAM, regardless of whether the asset manager is currently acting as a QPAM.

New Fiduciary Rule

- Analyze and inventory which services, if any, are provided to investors in the capacity of an ERISA fiduciary.

- If multiple investment services are provided to a particular client in the capacity of both an ERISA (or IRA) fiduciary and non-ERISA (or non-IRA) fiduciary, each service should be identified and inventoried.

- Implement procedures to maintain the distinction between ERISA (or IRA) fiduciary services and non-ERISA (or non-IRA) fiduciary services for the same client.

- Consider adopting a written policy or guidelines and train client-facing personnel regarding appropriate client communications – whether written or verbal – to help prevent unintended fiduciary status.

- Where multiple investment services are provided to a particular investor, the guidelines should describe appropriate procedures to help maintain the distinction between the ERISA fiduciary and non-ERISA fiduciary services.

Authored by David M. Cohen and Ian L. Levin.

If you have any questions concerning this Alert, please contact your attorney at Schulte Roth & Zabel or one of the authors.

[1] For simplicity, any reference in this Alert to the term “Plan” will generally mean plans subject to ERISA’s fiduciary rules, IRAs, separately managed account and funds-of-one of ERISA plans or IRAs and plan asset funds.

[2] In general, the crimes include a felony involving abuse or misuse of such person’s plan position or employment, or position or employment with a labor organization, any felony arising out of the conduct of the business of a broker, dealer, investment adviser, bank, insurance company or fiduciary, income tax evasion, any felony involving the larceny, theft, robbery, extortion, forgery, counterfeiting, fraudulent concealment, embezzlement, fraudulent conversion or misappropriation of funds or securities.

This communication is issued by Schulte Roth & Zabel LLP for informational purposes only and does not constitute legal advice or establish an attorney-client relationship. In some jurisdictions, this publication may be considered attorney advertising. © 2024 Schulte Roth & Zabel LLP. All rights reserved. SCHULTE ROTH & ZABEL is the registered trademark of Schulte Roth & Zabel LLP.